Build a Capital Strategy That Makes Your Business Grow Faster

Founder-to-founder guidance for raising debt, building liquidity, and scaling without giving away equity. Trusted by 1,300+ founders across Europe.

The Typical Founder Conversation

After reviewing 10,000+ business loan applications, I see the same conversation repeat itself.

Founder: “I’m overloaded. Sales, operations, people… 70 hours a week. We don’t need loans.”

Me: “That’s normal. Most founders don’t have a financial background. But tell me — do you want to grow faster?”

Founder: “Of course.”

Me: “Then you should know there’s a third path. Besides bootstrapping and investors, you can borrow from banks, grow faster, increase ROE — and keep 100% of your shares.”

Founder: “I never thought of it that way… but we’re fine for now.”

Me: “For now. But business loans take 2–6 months to secure. And most founders only think about funding when it’s already too late.”

Founder: “Maybe… but my company probably won’t get approved. Banks reject us.”

And the same pattern continues.

→ Listen to the full conversation below

How I Solve It

I take everything I’ve learned and turn it into a simple, repeatable system.

Free Resources & Webinars

Practical tools, diagnostics, and content to help you grow smarter, fund faster, and perform better – without the guesswork.

Founder Frameworks

Proven tools to help you think clearly, plan smarter, and raise capital with structure instead of guesswork.

Workshops, Masterclasses, 1:1 Advisory

Group learning and step-by-step strategy building.

Founder-to-founder clarity calls and deep capital strategy sessions.

Ready for a change?

Before

✖ Stuck in the same revenue for 12 months

✖ Growing on your own cash and burning out

✖ Giving away 10–30% equity because loans feel “too risky”

✖ Facing 60%+ rejection rates from banks

✖ Messy documents slowing every financial decision

After

✔ Scaling 2–5x faster with a clear capital strategy

✔ Using bank loans to grow with 100% ownership

✔ Getting approvals by targeting the right lenders

✔ Clean, organized data room that accelerates decisions

✔ Operating with clarity, confidence, and control

Who Am I

I help founders turn capital into a growth engine.

I’m Arthur Geisari — founder, ex-Ernst & Young, ex-CFO, and entrepreneur behind 36 companies. I’ve helped 1,300+ founders raise debt, build strategy, and grow faster by understanding one simple truth:

Loans → Liquidity → Profitability.

My work combines finance, entrepreneurship, and real-world scars.

Featured Free Resources

Weekly Email Newsletter

Tactics, tools, event announcements and many more.

LinkedIn Posts

Daily insights on funding, mindset, and business growth.

52 Business Failure Reasons

A clear list of the 52 most common reasons companies collapse.

Trusted by Founders Across Europe

S. Garcia

Owner, logistics

"This blueprint is priceless. Using negotiations tactics I got good offer from BnP Paribas."

Chris

Construction Founder

"This masterclass gave me the cleanest funding roadmap I’ve ever seen."

Martin

Tech CEO

“This was like a financial X-ray. Arthur fixed my strategy in week one.”

With Us You Will Get

Time Economy

Buy time with knowledge & outsourcing of the debt fundraising process.

Learn Process

Get a solid understanding and knowledge of how business loans work. It stays forever.

Grow Business

Grow your revenue and profit. Increase return on equity.

As seen in Media & Press

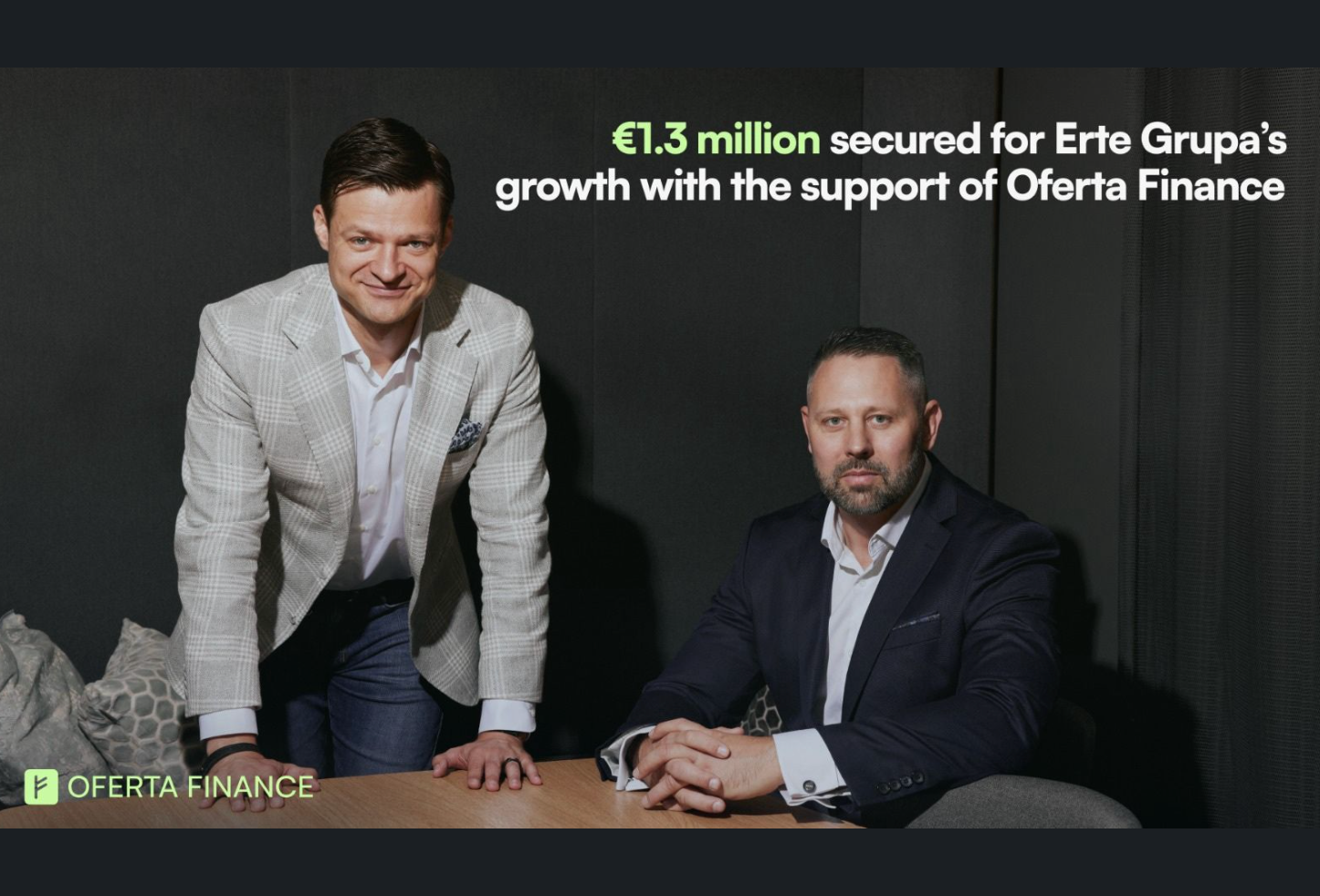

€1.3 million fundraised in 1.5 months from a bank

Oferta Finance helped to secure a manufacturing company loan from a bank in a record time of 1.5 months.

Borrowing money from banks

Open Discussion with the Ministry of Economy, Unions & Lenders about why there are 3 times fewer loan issues in Latvia than in the EU.

Panel: Funding Trends

funders assess today’s financing trends. Shared insights on decision-making shifts in capital strategy.

Find Out How Much Your Business Can Borrow

Funding Calculator

Take the 60-second diagnostic and discover your borrowing capacity.

Subscribe To Our Newsletter

To get up-to-date info

Trusted in Europe. Built for founders.

Clarity → Capital → Growth.